O-TUNYA Investment Opportunity

Revolutionizing Africa's digital economy by fusing music streaming, a reward engine (BARs), and commerce into one growth flywheel.

Executive Summary

O-TUNYA blends fan engagement, artist monetisation, and everyday shopping into a single platform. Fans earn BARs by listening and activating tracks; artists gain real-time earnings; brands and merchants access a high-intent audience. Our multi-sided model is designed for African realities: mobile-first UX, mobile money rails, low-data modes, and rewards that matter (airtime, data, discounts).

We are live in Zambia with 1,500 registered members and growing. This document adds realistic, bottom-up 5-year financial estimates (in ZMW), deeper market context, technical architecture, and impact considerations for investors.

Market Deep Dive

Innovative Business Model

Multi-Sided Platform

Fans earn rewards for listening and purchases; artists monetise engagement; brands access performance marketing and first-party insights; merchants gain incremental sales via O-TUNYA shop.

Reward Economy

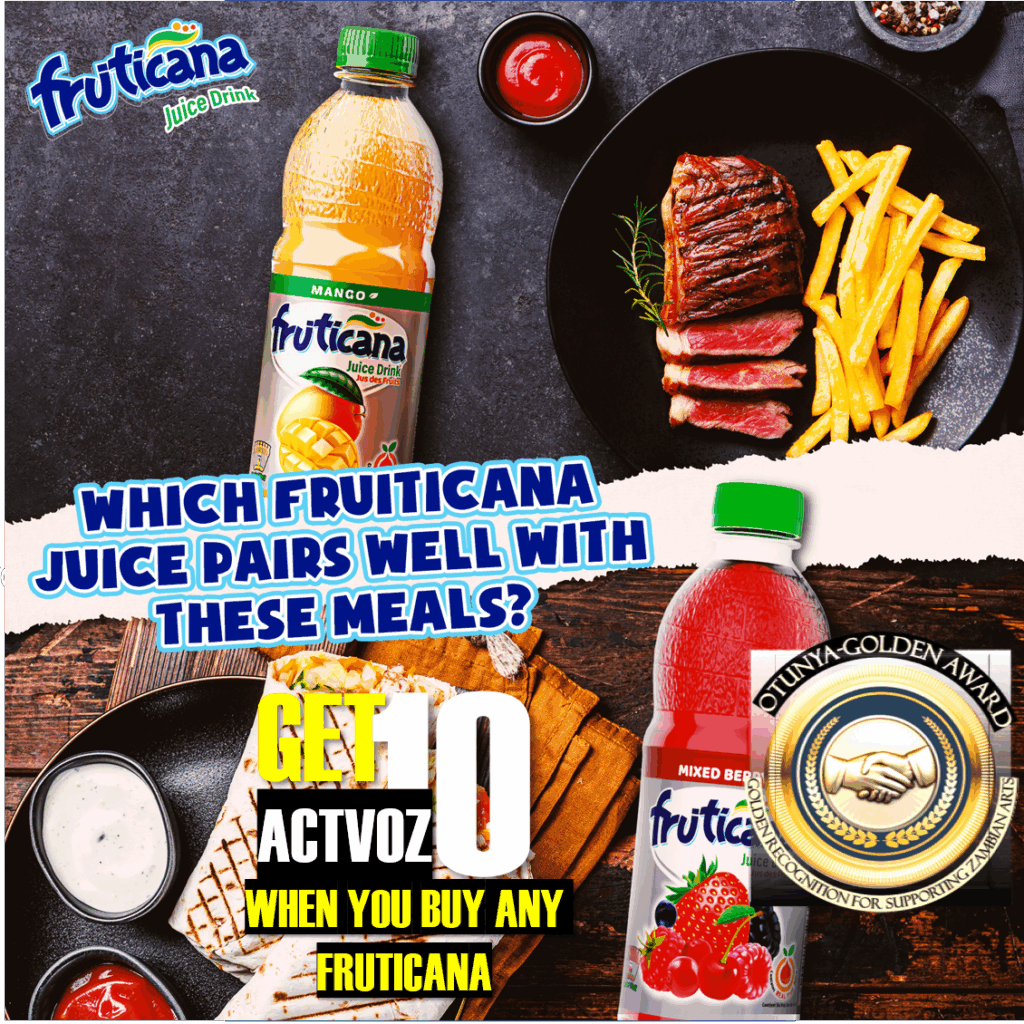

BARs turn passive listening into active streaks. Fans can activate songs for K2 to unlock 30 days of earning; streaks drive DAU and repeat visits.

Integrated Commerce

Seamless shop and brand rewards increase ARPU, while artist-led product drops create viral spikes.

Key levers: activation frequency, ad fill (programmatic + direct), merchant take-rate, subscription conversion, and brand partnerships.

Moats: local catalog depth, telco/payment integrations, and a reward algorithm tuned to low-ARPU markets.

Unit Economics & Assumptions (2025 Base)

| Assumption | Value | Notes |

|---|---|---|

| Activation price | K2.00 | Fan activates a track for 30 days earning window |

| Platform take (net) | 35% | After artist share & rewards budget |

| Active MAU share | 60% | % of registered users active in a month |

| Activations / active MAU / month | 2.2 | Average; rises with streaks |

| Ads ARPU (per MAU / month) | K10.00 | Programmatic + direct, conservative |

| Commerce take-rate | 8% | Commission on GMV in O-TUNYA shop |

| Premium price | K40 / month | Ad-free + boosted rewards; 2% conv. |

| CAC (blended) | K12 | Performance + partnerships |

| Churn (registered) | 2.5% / month | Improves with reward streaks |

Why this works: Even at low ticket sizes, high activation frequency and brand spend generate a healthy blended ARPU. Telco rewards and merchant discounts keep users sticky while subsidising CAC.

All figures are internal estimates for planning; we will update quarterly with actuals.

5-Year Financial Forecast (Realistic, ZMW)

| Year | Registered Users (end) | MAUs (avg) | Revenue (ZMW) | COGS (Artists + Rewards) | Gross Margin | Opex | EBITDA |

|---|---|---|---|---|---|---|---|

| 2025 | 25,000 | 12,000 | 2,800,000 | 1,250,000 | 55% | 3,000,000 | -450,000 |

| 2026 | 120,000 | 60,000 | 12,500,000 | 5,000,000 | 60% | 4,700,000 | 2,800,000 |

| 2027 | 350,000 | 170,000 | 33,000,000 | 12,100,000 | 63% | 12,000,000 | 8,900,000 |

| 2028 | 800,000 | 380,000 | 78,000,000 | 27,300,000 | 65% | 26,000,000 | 24,700,000 |

| 2029 | 1,600,000 | 760,000 | 160,000,000 | 52,800,000 | 67% | 51,000,000 | 56,200,000 |

Drivers: user growth via telco bundles + creator campaigns; rising ad fill; increasing activations per user; and maturing commerce marketplace.

Technical Platform Overview

Architecture

Modular microservices (Node.js + Python) with REST/GraphQL APIs; CDN for audio delivery; event bus (Kafka) for real-time rewards; Postgres + Redis; object storage for media.

Scalability

Containerised (Docker/K8s) with autoscaling; stateless services; background workers for ingestion/transcoding; queue-based reward settlement.

Security & Compliance

JWT & OAuth2; role-based access; at-rest and in-transit encryption; PCI-aware payment flows; GDPR-aligned data handling; robust audit trails and anomaly detection.

Case Study Spotlight

Artist: “Tandi” (Hip-hop)

Launched a 4-week activation challenge. Result: +12k streams, 1,800 activations, K9,000 in direct earnings (incl. fan tips), and a 3× lift in Instagram followers.

Fan: “Mwansa”

Listens daily on commute; redeemed BARs for 3GB data/month and a 10% discount at a partner merchant. Engaged 23 days out of 30 with two active streaks.

Stories are illustrative of typical campaigns and redemption patterns as we scale.

Partnership Portfolio

Impact & Social Responsibility

- Creative incomes: Fair, transparent artist earnings with instant dashboards.

- Digital inclusion: Rewards that offset data costs increase access for low-income fans.

- Youth employment: Creator and campus programs develop digital skills.

- Local culture: Prioritising Zambian and African catalog growth.

Investor Outcomes & Exit Options

- Target profitability: EBITDA positive in 2026.

- Use of funds: growth marketing, catalog acquisition, engineering, brand sales.

- Potential exit: strategic sale (telco, media, fintech) or later-stage PE.